Summary: De.mem (ASX: DEM)

De.mem started operations in 2014 with the vision to become the leading provider for de-centralized, membrane-based solutions for industrial and domestic water treatment. In the meantime, the company has grown to about 75 employees with offices in Brisbane, Perth, Kalgoorlie, Launceston, Melbourne, Wodonga (Australia), Singapore, and Velbert (Germany).

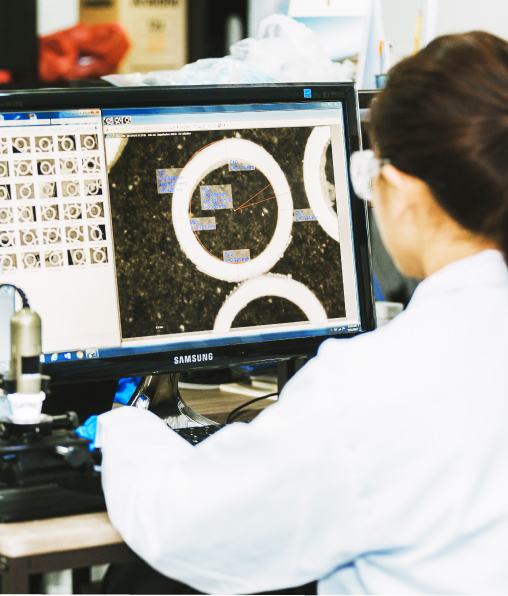

De.mem offers a range of Singapore-made hollow fibre membranes, often deployed as the key component of its products. This includes innovations such as the company’s graphene-oxide enhanced polymer membrane.

Key milestones in the development of De.mem are as follows:

- 2015 Completed a number of municipal / residential projects in Vietnam

- 2016 Signed lighthouse industrial waste water BOO contracts with multinational corporations in Singapore

- 2017 Listed on the Australian Stock Exchange

Started factory for the production of hollow fibre membranes in Singapore

Signed contracts with leading players from the Australian mining sector - 2018 1.7 million A$ award for waste water treatment plant in South Australia

- 2019 2.8 million A$ award for seawater desalination plant in Queensland

1.7 million A$ Build, Own, Operate contract for industrial waste water treatment in Singapore

Acquired Pumptech Tasmania Pty Ltd (now: De.mem-Pumptech) and Geutec GmbH, Essen, Germany (now: De.mem-Geutec) - 2020 2.7 million A$ contract for supply of a seawater desalination plant

- 2021 Acquired Capic in Perth, Western Australia (now: De.mem-Capic)

- 2022 Acquired Stevco in Epping/Melbourne, Victoria (now: De.mem-Stevco)

- 2024 Received American NSF certification for Graphene Oxide enhanced membrane

Acquired Auswater Systems Pty Ltd and Border Pumpworks - 2025 Acquired Core Chemicals Pty Ltd, Perth, Western Australia